Related Insights

Ent Credit Union made a values-based decision to bring its credit card program in-house. Why? Because the third-party solution couldn’t deliver the high level of personalization, convenience, and member-first experience Ent is committed to. Bringing a credit card program in-house is no small feat. The risk of confusing customers, creating friction, and losing trust is real. But Ent was determined to create a program that truly serves its members’ financial well-being. They needed a strategic partner capable of ensuring a smooth transition that honored and added value to its members.

The result? Personalized credit card products, seamless user experiences, and a meaningful upgrade.

Using a proven strategy for designing and launching new credit cards, the team developed five compelling offerings, four personal and one business, each thoughtfully tailored to support diverse financial goals and lifestyles.

Guided by member insights at every step, Ent ensured real users shaped everything from key decisions and product features to card design and user onboarding.

We supported the in-house transition and new credit card rollout with strategic planning and targeted execution across key marketing channels. Services included:

Pathfinders collaborated closely with Ent, blending deep research, creative design, and operational excellence so the card rollout felt less like a disruption and more like an upgrade.

To keep everyone aligned under tight timelines, Pathfinders developed a complete brand kit for each credit card including personas, card art, messaging, graphics, photo libraries, and more. This preparation ensured every detail was ready to execute as soon as it was needed.

Full suite of credit cards are prominently displayed with “Learn more” CTA positioned above the fold.

Eye-catching red banners highlight key acquisition incentives, like zero-percent introductory rates, to capture user attention.

Concise chart allows users to quickly compare rewards, rates, and perks across all cards.

Interactive filters enable users to refine card options based on preferences like rewards type, interest rates, or credit profile.

Individual card tiles showcase key features and offer two CTAs: “Apply Now” for conversion-ready users and “Learn More” for those seeking additional details.

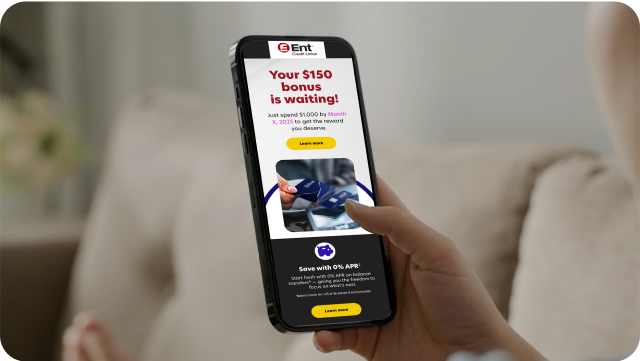

With the majority of Ent members banking digitally, we took a mobile-first approach to design. Emails were not only optimized to fit various device sizes, but also work in dark mode, as 85% of Ent’s members prefer it.

We set out to bring the cards to life in every setting – especially in service centers. From eye-catching door clings to dynamic digital signage and engaging point-of-purchase materials, each element was thoughtfully crafted to shape the journey centered on what matters most to Ent: its members.

Every detail, even down to the most practical pieces like card carriers, inserts, and buck slips, was designed with members in mind for every step of their card journey.

The result went beyond bringing a credit card program in-house to establishing a strong foundation for long-term member loyalty. This meaningful shift gave Ent the flexibility to better serve members with more personalized offerings based on member feedback and to continuously evolve the program in step with their needs.

Ent members now have credit card options designed to support their lifestyles and goals throughout every stage of their financial journey.