In the world of credit card marketing, staying on top of competitors’ strategies, offers, and positioning is crucial for maintaining a competitive edge. Whether you’re looking to improve your current portfolio or launch a new product, conducting a thorough competitive analysis is key to understanding the marketplace and staying relevant.

In this guide, we’ll walk you through how to effectively assess the competition, present your findings, and apply those insights to your own credit card marketing strategy.

Why conducting a competitive analysis for your credit card portfolio is essential

Credit card portfolios thrive in a highly saturated market where product differentiation and consumer perception matter. By conducting a competitive analysis, you gain insights into what works, what doesn’t, and how your competitors are positioning themselves. This allows you to:

- Identify trends and shifts in the market.

- Understand competitor strengths and weaknesses.

- Tailor your offerings to meet gaps in the market.

- Refine your marketing strategies to better resonate with your target audience. Creating relevant customer personas plays a key role in this.

Regularly analyzing the competition ensures that you can stay ahead of the curve, continuously refining your product offerings and marketing approaches.

Step 1: Identify your competitors

The first step is to clearly define who your competitors are. These are typically other financial institutions or credit card issuers targeting the same customer segments as you. Your competitors can be divided into:

- Direct competitors: These are issuers offering similar types of credit cards (e.g., rewards cards, low-APR cards) targeting the same consumer demographics.

- Indirect competitors: These might be companies offering alternative payment methods, like buy-now-pay-later (BNPL) services or digital wallets, which could steal your market share.

To identify your competitors:

- Look at who dominates search engine results when you search for credit cards similar to yours.

- Analyze social media platforms to see which brands are being discussed within your market.

- Review industry reports and market studies for lists of key players.

By categorizing and listing your competitors, you can narrow down the analysis to those that have the biggest impact on your target market.

Step 2: Research and collect competitor data

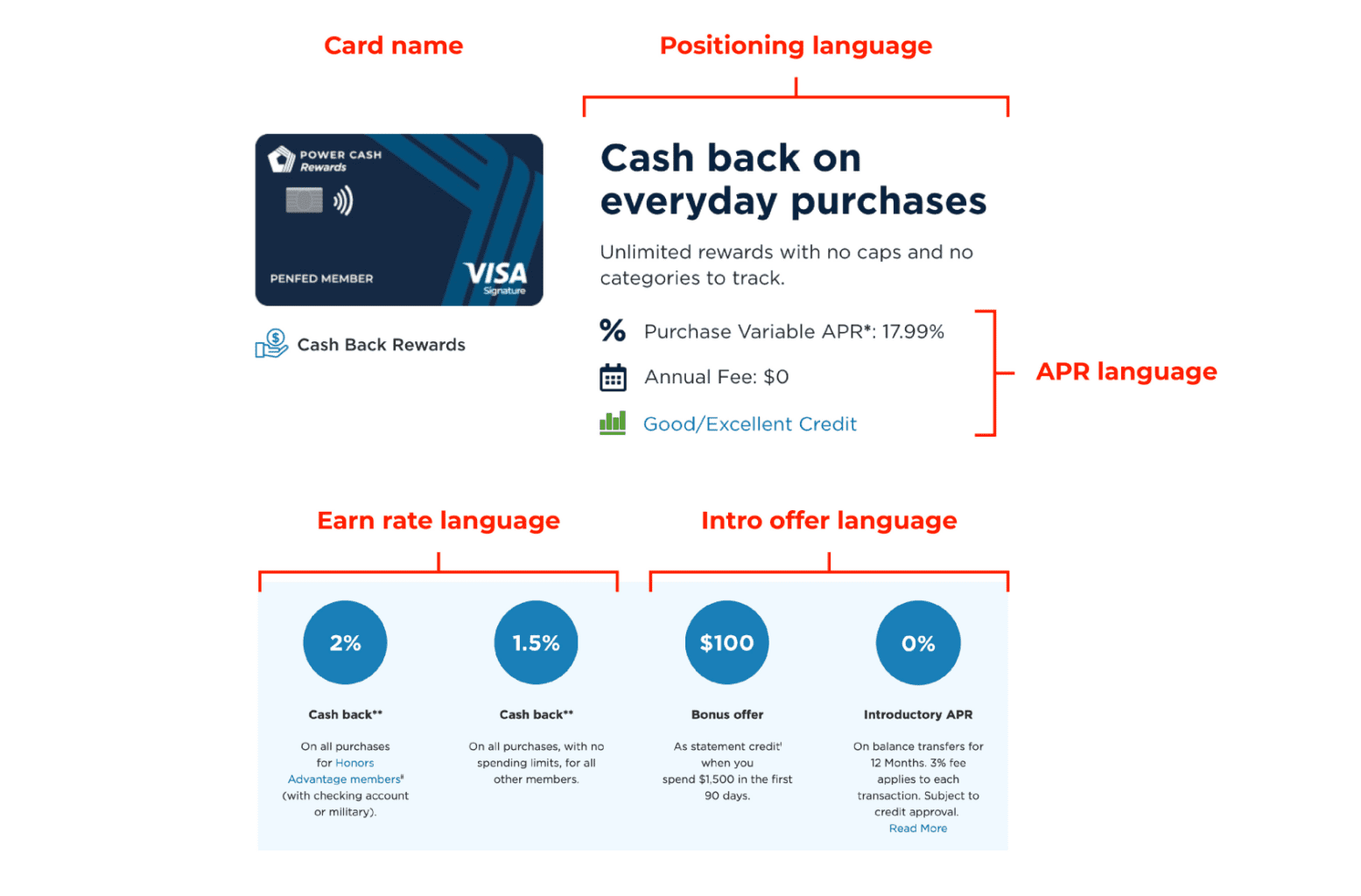

Once you’ve identified your competitors, it’s time to gather relevant data on their offerings. Focus on collecting information that directly impacts consumer choice. Here’s what to look for:

- Interest rates (APRs): Look at both standard and promotional APRs to compare how competitors are pricing their products.

- Fees: Check annual fees, balance transfer fees, foreign transaction fees, and late payment fees.

- Rewards programs: Compare the structures of cashback, points, and travel rewards programs.

- Sign-up bonuses: Review introductory offers, like “Earn $100 when you sign up for a new card,” and see how your competitors are enticing new customers.

- Earn rates: Break down how competitors have structured their earn rates. For example, are they offering 5x points on specific categories or 3x points in other areas?

- Rewards value: Assess the value of rewards points. For example, is 1,000 points worth a $10 gift card, or something more valuable?

- APR offers: Investigate what types of APRs competitors offer for customers carrying a balance. Are they in the range of 17%-24%?

- Unique features: Be on the lookout for anything distinctive you notice during your research. This might include a unique card design, a creative rewards structure, or even a website that’s particularly user-friendly.

This data can be sourced from competitors’ websites, comparison sites, and industry reports. The more sites reviewed, the more comprehensive the research.

Step 3: Analyze competitor positioning

A competitor’s product features are only part of the equation. How they present and position that product is just as important. By analyzing their messaging, branding, and positioning, you can determine what kind of narrative they are using to attract customers. Focus on:

- Target audience: Are they marketing toward millennials, affluent customers, or those with poor credit?

- Brand personality: Is the brand projecting trust, innovation, simplicity, or luxury?

- Value proposition: What is their main selling point — low interest rates, superior rewards, or no fees?

By understanding how competitors are positioning their products, you can identify areas where your own brand might stand out or improve.

Step 4: Dig in to competitor advertising strategies

Marketing channels are just as important as the products themselves. Look at how your competitors are reaching their audience and what platforms they’re using. Key areas to monitor include:

- Digital marketing: How are competitors leveraging Google Ads, social media platforms, or email marketing to capture new customers?

- SEO strategies: Analyze their online presence. Which keywords are they ranking for, and what kind of content are they producing to drive traffic?

- Direct mail campaigns: Many credit card issuers still use direct mail. Review the frequency, design, and messaging of competitors’ mailers and see how their direct mail compares to their digital tactics.

There are a variety of tools that can help you with this part of your competitive analysis. For SEO and PPC insights, you can use SEMRush or Ahrefs. For social media, Meta enables you to see any ads running on their platform. You can also leverage panel-based services like Competiscan or Mintel’s Comperemedia platform to get detailed reports and insights (but for a price!).

Step 5: Showcase your findings effectively

Once you’ve completed your competitive analysis, the next step is to present the information in a way that is easily digestible for stakeholders. A well-organized presentation can help your team quickly get up to speed and act on insights.

One of the most effective ways to capture and present your competitive analysis is through a PowerPoint presentation. This format allows you to combine text, images, and links that paint a vivid picture of your findings. You can:

- Incorporate visuals such as charts and comparison tables to highlight key differences in competitors’ offers.

- Embed links to specific competitor pages, research reports, and articles to provide additional context for those who want to dive deeper.

- Use bullet points to break down complex information into bite-sized, easy-to-understand pieces.

Remember, your goal is to create a deliverable that anyone could pick up and quickly get up to speed on what’s happening in the landscape.

Pro tip: Chase your curiosity

When conducting a competitive analysis, don’t be afraid to follow your curiosity. For example, if you see a 4 on a 5-star rating on a site like Nerd Wallet, ask yourself: What would it take to get 5 stars? Even if the highest-rated cards aren’t directly comparable to your portfolio, understanding the benchmarks for excellence can give you a better sense of where your offerings stand and what you can improve.

Conclusion

Conducting a competitive analysis isn’t a one-time event. The credit card industry is always evolving, with new products, offers, and marketing strategies emerging all the time. By making competitive analysis a regular part of your credit card marketing strategy, you’ll ensure your portfolio stays relevant, customer-focused, and profitable.

Our competitive research presentation template makes it easy to showcase your findings with a professional, ready-to-use format. Save time and create impactful presentations that help you streamline your analysis, communicate your insights with confidence, and get your team up to speed quickly.

Competitive research presentation template

DOWNLOAD NOW