Launching a new credit card program can be a game-changer for financial institutions. When marketed well, a strategic card launch opens new revenue streams while laying the groundwork for deeper customer loyalty and long-term growth.

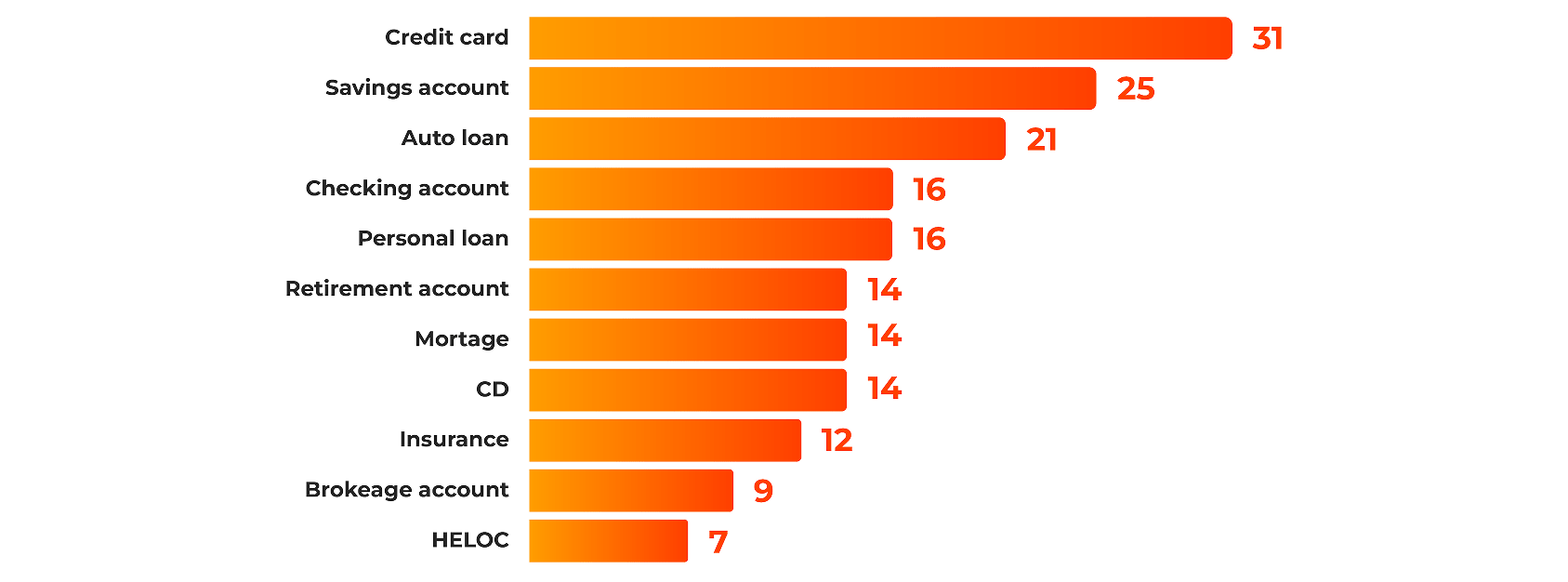

Credit cards continue to be one of the most in-demand financial products in the U.S. This consumer demand, coupled with their widespread use, make them a valuable growth opportunity for issuing banks and credit unions. Credit cards rank as the #1 most sought-after banking product (Rivel Banking Research, 2025) with 80% of U.S. households holding at least one card (Federal Reserve, 2022).

New products sought %

Winning both card acquisition and top-of-wallet status in today’s highly competitive landscape takes more than just compelling rewards. Success hinges on a well-informed strategy grounded in market insights, precise planning, and flawless card launch execution.

While every credit card launch is unique, the most successful programs follow a proven card marketing strategy and launch framework with seven essential phases. These foundational steps are the building blocks of effective, profitable credit card programs that stand out in the market, attract the right customers, and sustain long-term engagement and loyalty.

Seven phases of a a successful credit card launch

A successful credit card launch begins with a deep understanding of the competitive landscape. Conduct thorough market research to identify key trends, gaps, and opportunities. Use tools and data to assess competitor offerings and position your card uniquely in the market.

Know who your customers are, their preferences, and how you can meet their needs with a differentiated offering. This research will also help you determine the best marketing strategies to attract and engage your target audience.

To win in today’s crowded credit card market, your offering needs to go beyond basic functionality. It should speak directly to your target audience’s lifestyle, values, and financial goals. To earn a place at the top of your customer’s wallet, consider offering features that matter to them such as:

- Competitive rewards programs

- Flexible credit limits and low interest rates

- Exclusive perks tailored to specific demographics and psychographics, such as travel rewards or cash back

- Introductory APR offers that entice new cardholders

- Sign-up bonuses and spend-based rewards that drive engagement

While capturing top-of-wallet status is ideal, we’ve seen strong performance and engagement even from cards that occupy the second or third position. Credit card usage is surging: by mid-2023, the U.S. had 167.2 million credit card users, a significant increase over prior years (TransUnion, 2024). And with credit card spending projected to reach $6.3 trillion by 2026 (Nilson Report, 2025), the opportunity is massive.

In a competitive environment, designing a compelling, customer-centric card is essential for acquiring new cardholders and building lasting loyalty.

At the core of every successful credit card program is a deep understanding of the customer. Their behaviors, preferences, and pain points should inform every decision, from product design to digital application flow.

Use all the tools to uncover what your customers truly want. Combine quantitative data (surveys, behavioral analytics, application trends) with qualitative insights (focus groups, interviews, pilot testing) for a well-rounded perspective. This balanced approach helps you validate assumptions, identify unmet needs, and fine-tune your card program before launch.

Today’s tech-savvy consumers expect speed, simplicity, and a seamless onboarding experience from application to activation.

A credit card is more than just a payment tool you offer to customers. It’s a financial product that must be profitable and sustainable for your institution.

Build detailed financial models to assess:

- Interest rates and fees that balance value to customers with profitability

- Customer acquisition costs (CAC) and lifetime value projections (LVP) to understand long-term revenue potential

- Risk management strategies that account for delinquency, charge-offs, and fraud prevention

Careful financial planning ensures your card program remains profitable from start to scale.

Behind every successful credit card program is a solid operational engine. From compliance and fraud prevention to onboarding and servicing, your infrastructure must be designed to scale efficiently while delivering a seamless customer experience.

It starts with ensuring the right systems and partnerships are in place, from core processors, compliance teams, and fraud tools to support platforms that can all adapt as your program grows. But infrastructure alone isn’t enough. Execution matters.

Optimizing your card launch and acquisition strategy is critical to reaching the right audience at the right time. Equally important is outstanding customer service, a factor that’s increasingly driving brand loyalty and retention.

Consider this: after just one bad experience, 1 in 3 customers will walk away from a brand. After two or three, that number skyrockets to 92% (PwC, Future of Customer Experience).

When pricing, perks, and positive interactions align, you create an experience that earns trust, which is what turns a cardholder into a lifelong customer.

Before your official launch, pilot testing lets you validate and optimize your credit card offering in a controlled environment.

Use this phase to identify and eliminate friction in areas like:

- Application and approval processes to ensure speed, simplicity, and accessibility

- Mobile and online integration for a seamless digital banking experience

- Customer service and engagement touchpoints to support and confirm customer satisfaction

This important phase isn’t just for smoothing out technical issues; it’s about ensuring that your product resonates with your target audience.

By piloting your product with real users, you can optimize features, refine the user interface, and ensure your card delivers an exceptional experience that aligns with customer expectations and market demand.

Mobile optimization is non-negotiable with 50% of cardholders applying for credit cards digitally (Federal Reserve, 2024). In 2025, 43% of U.S. consumers opened a new credit card, with Gen Z (68%) and millennials (35%) leading adoption (The Financial Brand, 2025). Meeting customers where they are – digitally – is now table stakes.

Testing allows you to refine your card positioning, improve onboarding flows, and – if needed – adjust your go-to-market strategy before launch.

After months of planning, modeling, testing, and refining, it’s time to launch. A successful credit card rollout hinges on strategic marketing, smooth operations, including cardholder migration (if applicable), and full internal alignment.

Effective strategies for launch include:

- Targeted marketing campaigns that reach the right audience at the right time

- Seamless cardholder migration (if applicable) for a smooth transition for existing customers

- Comprehensive internal team training to prepare your staff to support and engage new cardholders

From the first transaction to ongoing usage, a strong launch creates momentum and sets the tone for long-term success.

Establish clear KPIs from day one to track adoption, engagement, and profitability. Use these metrics to fine-tune strategies post-launch and continue delivering value.

Final thoughts

A successful credit card launch starts with a strong strategy.

Launching a credit card program is more than a product rollout – it’s a comprehensive strategy that encompasses customer research, competitive analysis, financial modeling, and seamless execution.

By following these seven key phases starting with competitive research and ending with a strong, strategic launch, financial institutions can build card programs that do more than compete. They win share of wallet. They retain cardholder engagement. They grow profit margins and customer loyalty.

With the right groundwork in place, you can launch winning credit card programs.

Take your card marketing to the next level

READ OUR GUIDE